2 If Agi Floor

100 203 title x 10104 a dec.

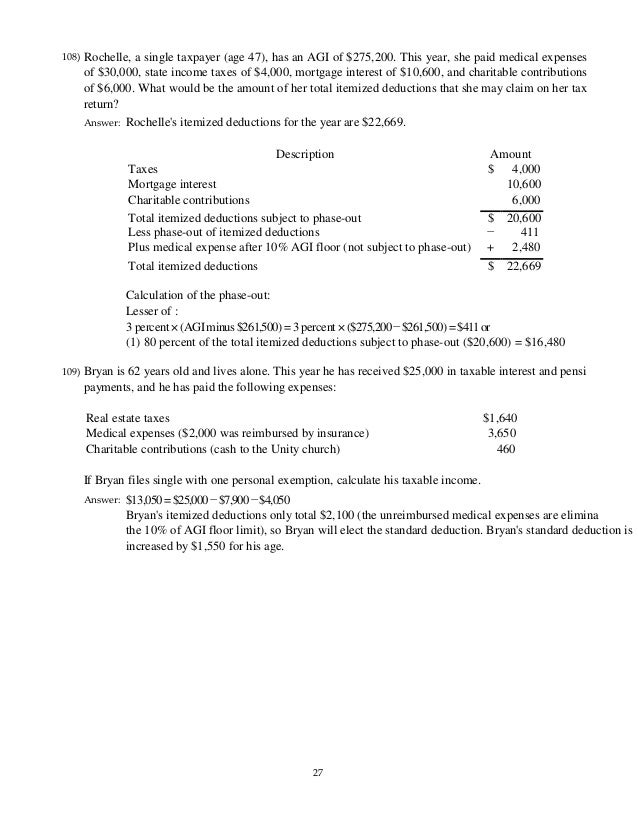

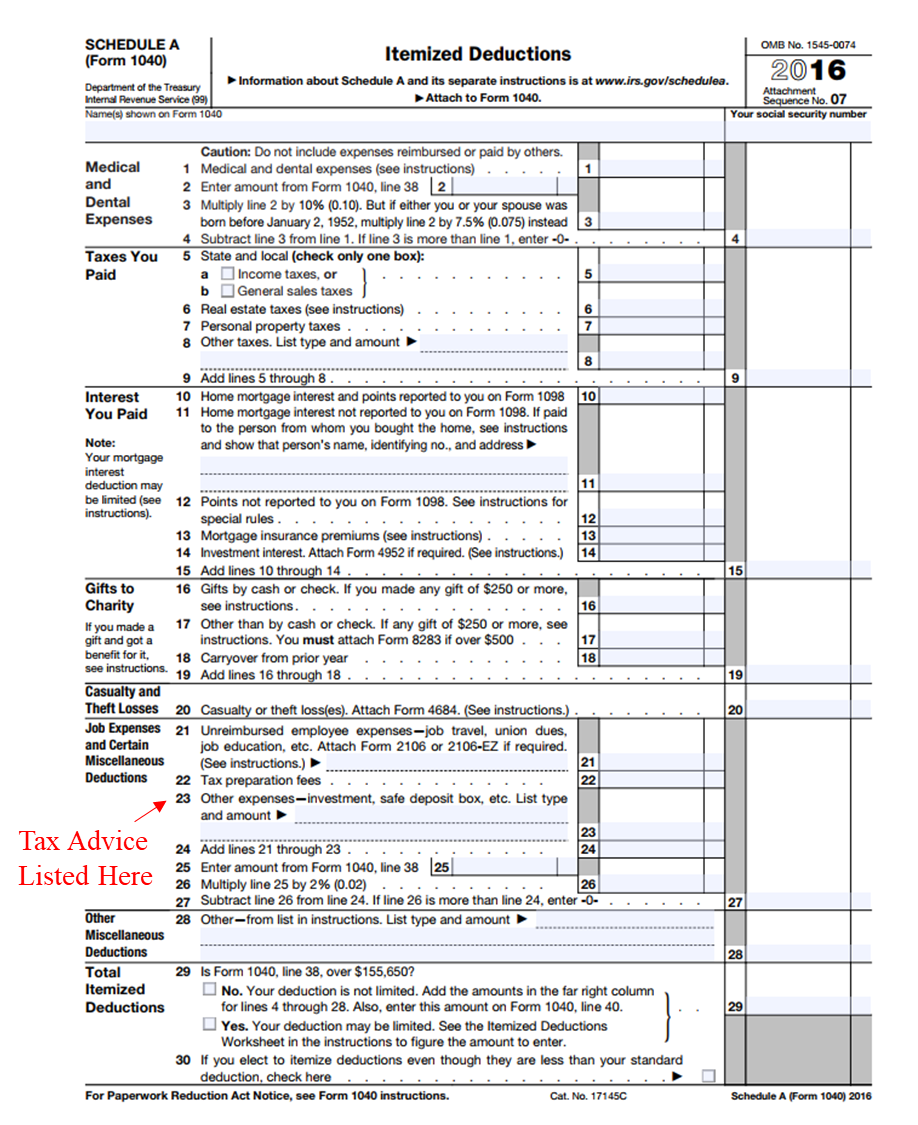

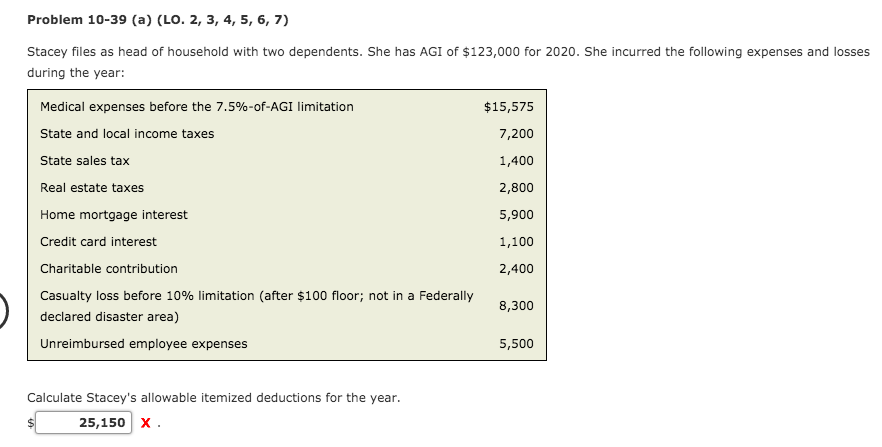

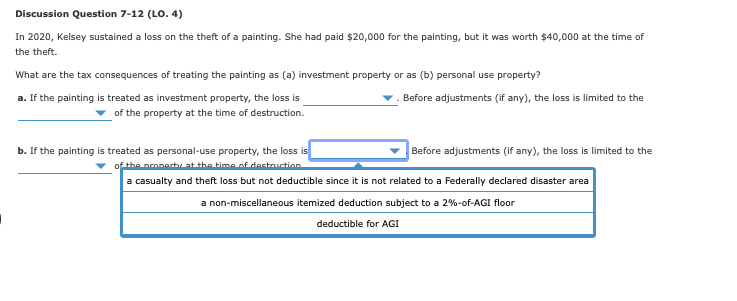

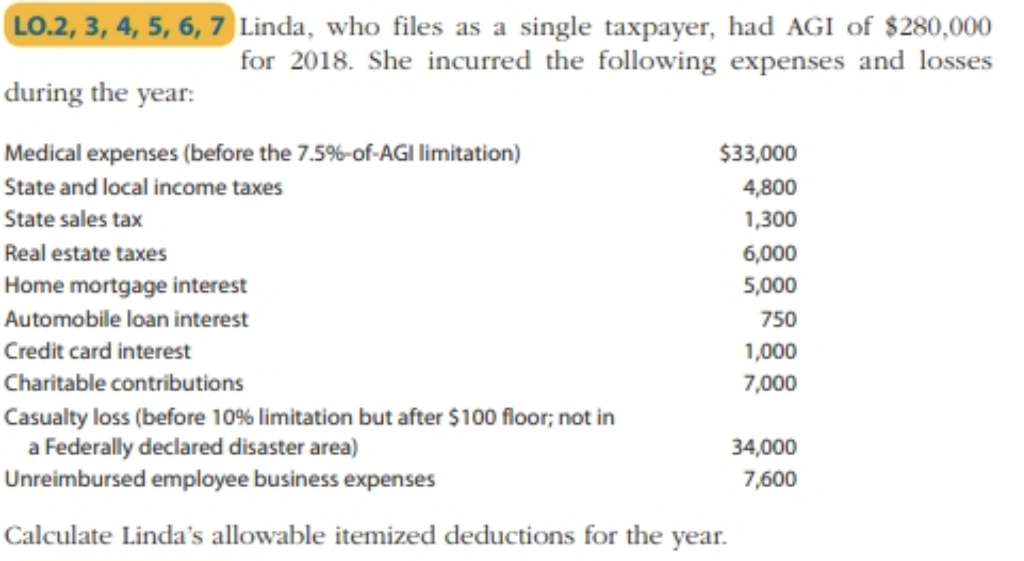

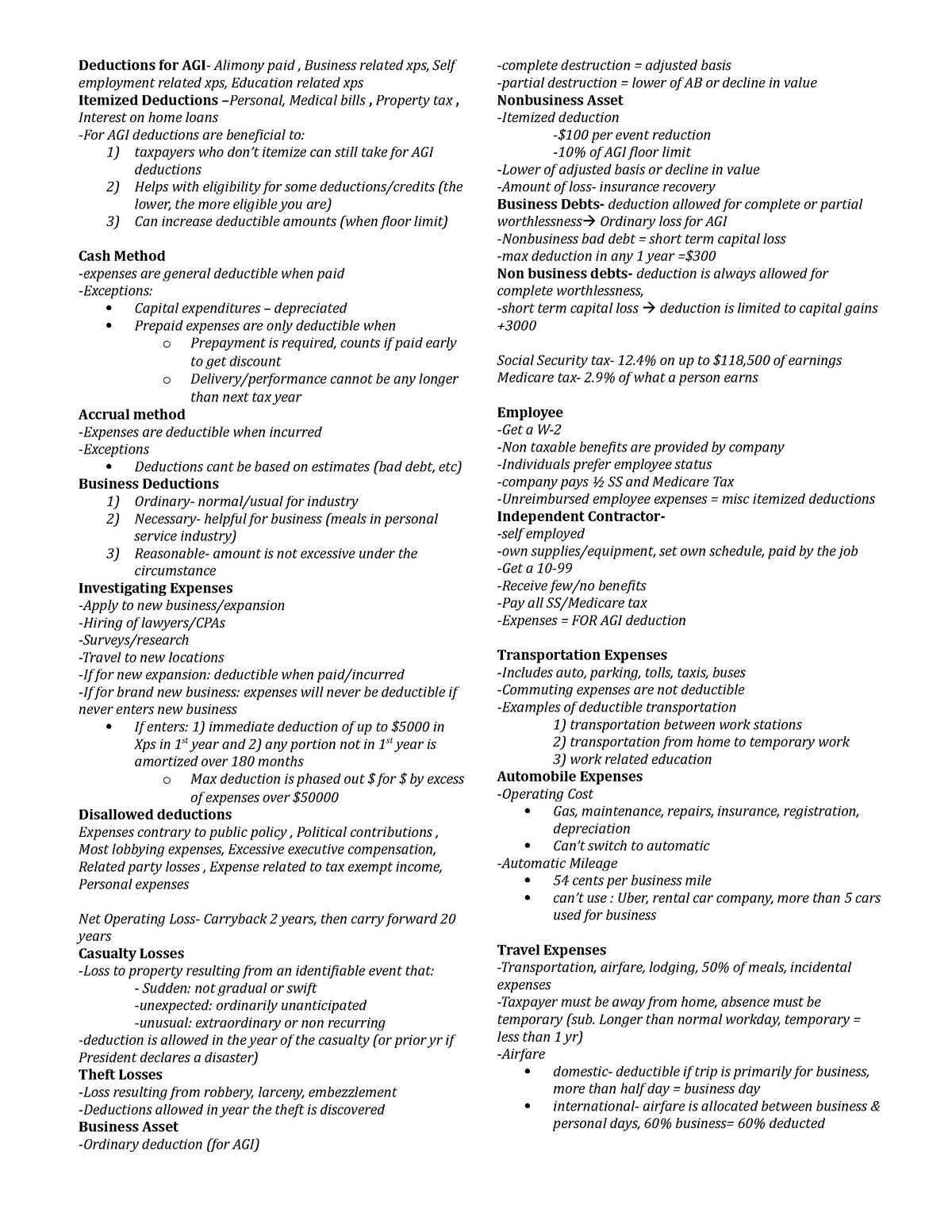

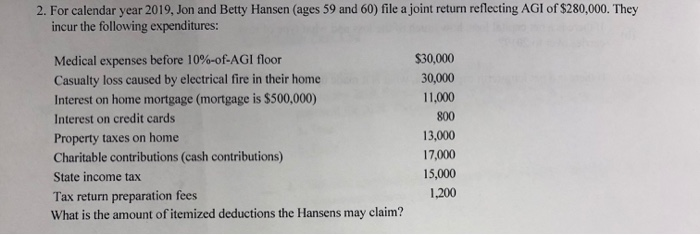

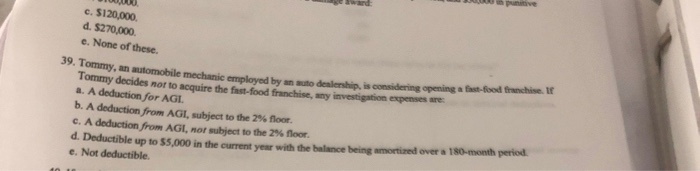

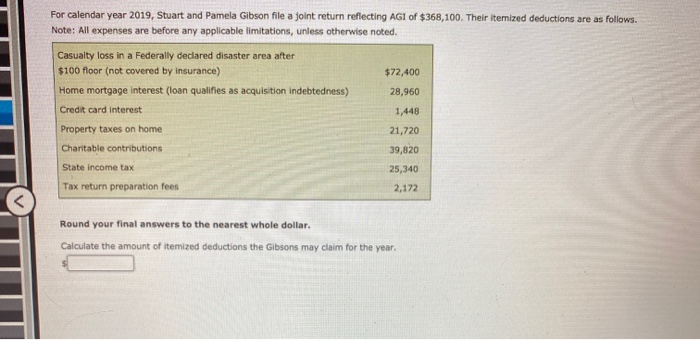

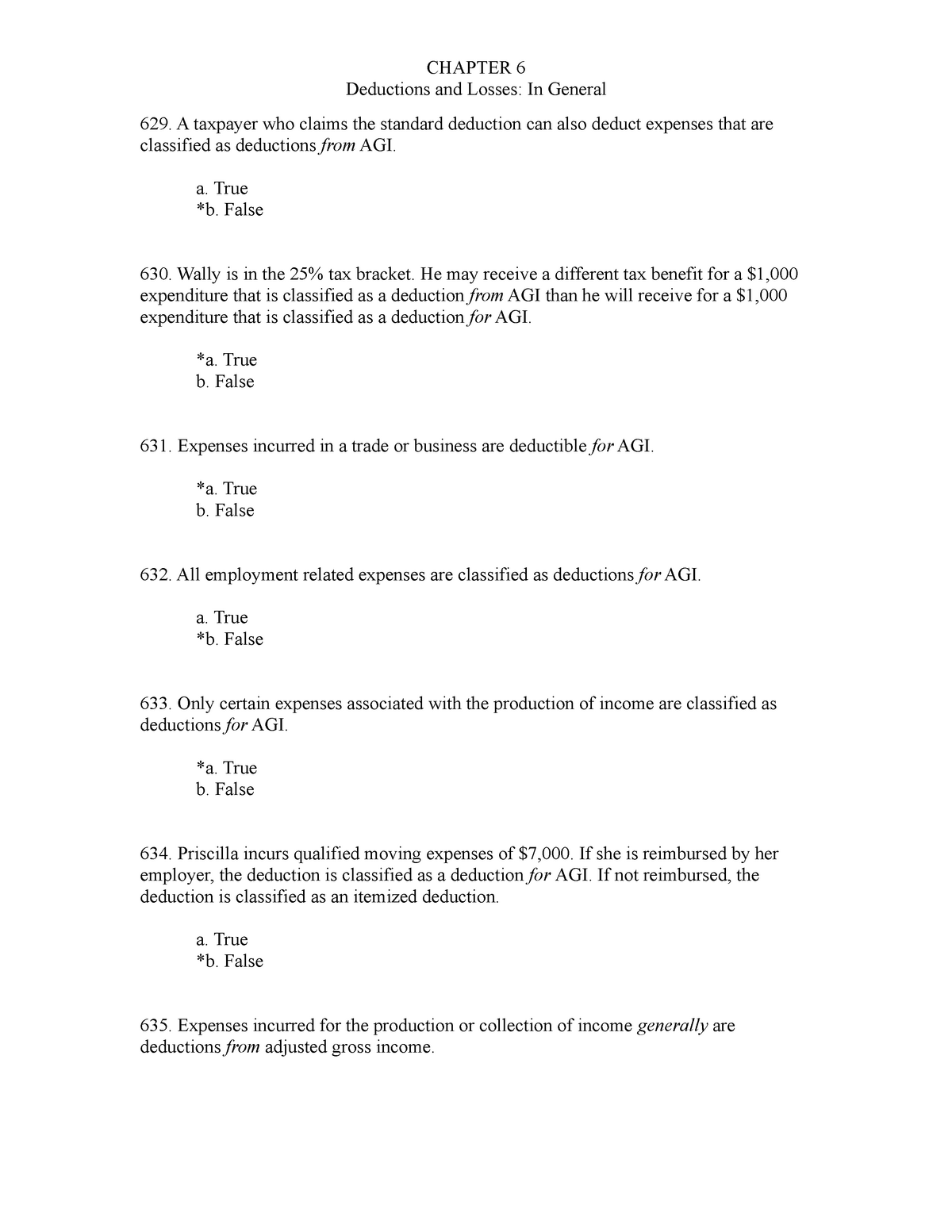

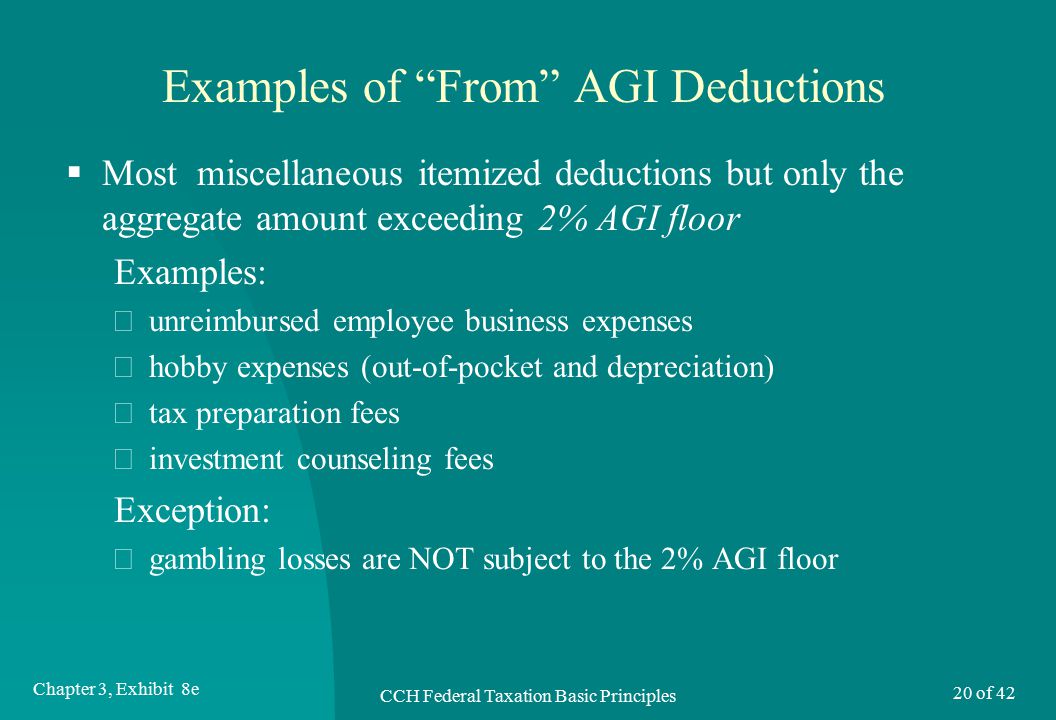

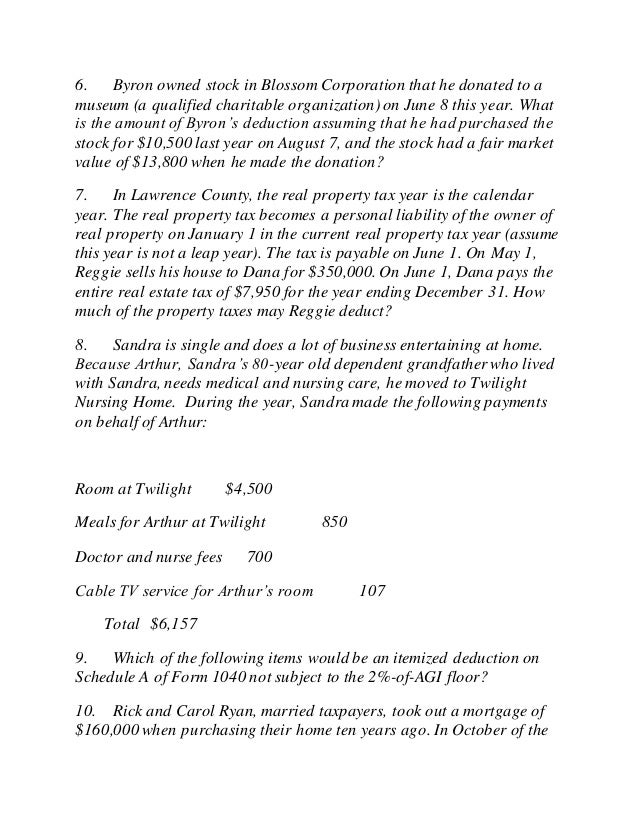

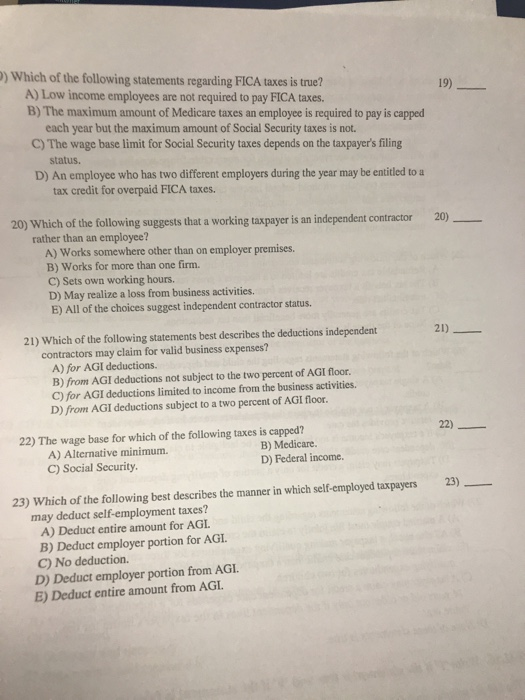

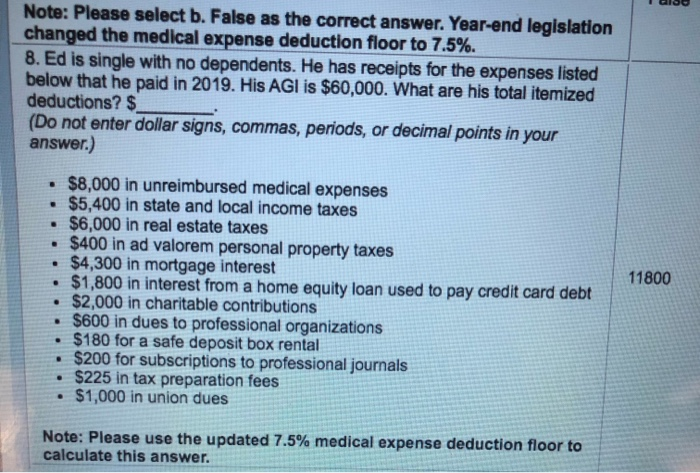

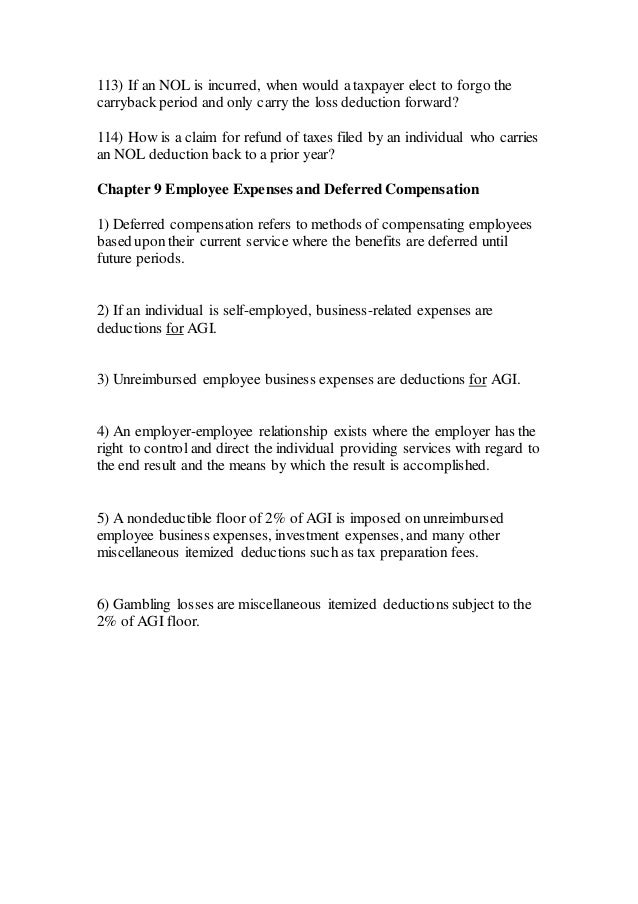

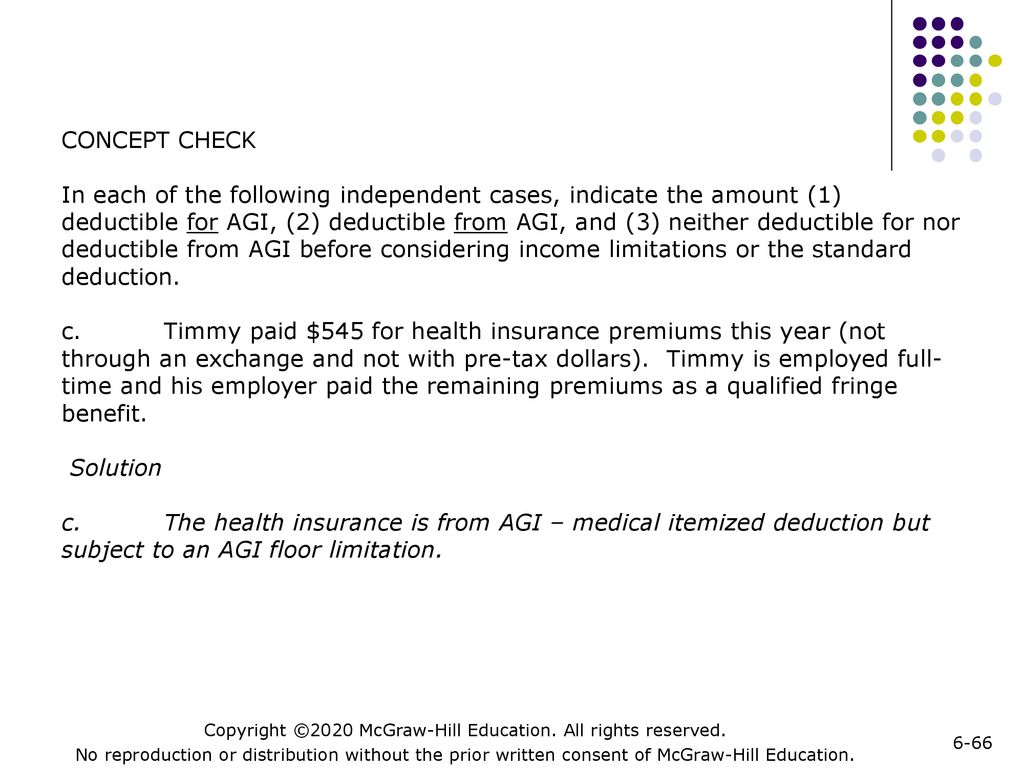

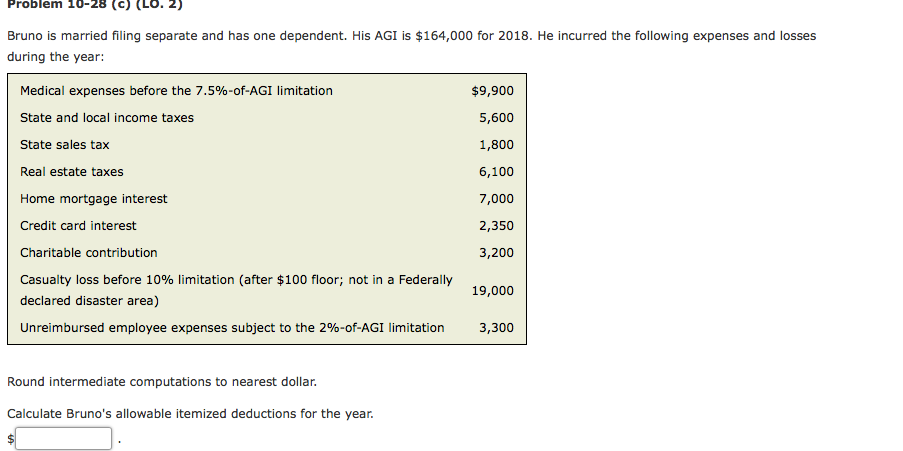

2 if agi floor. 22 1987 101 stat. Elimination of 2 floor itemized deductions news family wealth and estate planning tax tax planning and compliance manufacturing and distribution real estate and construction historically taxpayers have been afforded the opportunity to include various expenses in excess of 2 percent of their adjusted gross income agi in the. Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation. 02 x 30 000 600 line 25 of schedule a subtract 2 of his agi from his deductions that are subject to the rule.

Figure 2 of his agi. You can still claim certain expenses as itemized deductions on schedule a form 1040 1040 sr or 1040 nr or as an adjustment to income on form 1040 or 1040 sr. This publication covers the following topics. 1 year delay in treatment of publicly offered regulated investment companies under 2 percent floor pub.

1150 600 550 line 26 of schedule a even though he had expenses totaling 1150 because these particular expenses were subject to the 2 rule his net deduction that he will receive on his return for. For example if your agi is 50 000 your floor will be 2 percent of that or 1 000. 1330 386 provided that.